The following is a letter to the editor of Widesrceen Review, originally published in the September 2007 edition, and reprinted here with permission of the publisher, Mr. Gary Reber.

Gary:

Kudos to your recent editorial on the state of the industry. Many of your sentiments resonated very loudly with me since I personally witnessed market impacts you described. I have since left DWIN Electronics earlier this year and found a niche consulting with other manufacturers on marketing and sales management issues, product development and business development.

I would add three more trends that have made a large impact on our industry:

- Digitization of display technology: back in the day, high-end display manufacturers were revered for their ability to create a high-quality image from a relatively poor quality NTSC analog signal. The early pioneers who mastered the black art of analog video were rewarded handsomely for their skills. Today, with high-quality digital HD signals and digital imaging technology, many more companies can assemble a chipset that will deliver very good quality at a very low cost. More competitors usually mean lower prices.

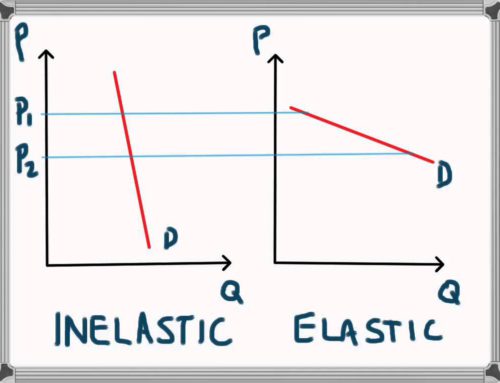

- Influence of Chip Manufacturing: a related trend is the economics of semiconductor chip (and LCD panel) production. The “race-to-the-bottom” phenomenon reflects the fact that large-scale investments are required to build a chip or panel “fab” (fabrication facility). When a company has billions of dollars of capital at risk, it is essential to seek the highest possible unit volumes as soon as possible to recoup costs. As prices decline, demand usually increases, so there is a strong built-in incentive for the chip company to lower prices. The chip company benefits by earning back their billion dollar investment. The consumer benefits from very low display prices with very much improved quality. Small manufacturers and integrators get squeezed in the middle.

- Convenience vs. Quality: In the audio market, consumers (especially younger buyers) overwhelmingly prefer convenience (IPod) to quality. (The popularity of products like Apple TV, YouTube, cellphone video and IPTV indicate a similar trend in store for video). Consumers do appreciate high-quality video and audio, but, I believe they are making rational trade offs: ease-of-use and portability versus superior quality.

So, what’s the solution?

First, small manufacturers with legitimate engineering and quality advantages should price products at appropriate levels and resist competition from low-priced brands. (BMW, Mercedes and Lexus all thrive despite the presence of Hyundai, Kia and Daewoo). Small brands should offer high-quality services and support, for consumers and dealers alike. Small brands should enforce premium pricing and position by being more selective in dealer recruiting. And small brands should be aggressive at weeding out poor performing, marginal dealers that don’t have the right qualifications, or the technical ability. Dealers with insufficient capital, weak staff training and inept customer service drain resources from small manufacturers.

Second, if manufacturers want to maintain premium pricing, they should not distribute products indiscriminately. If you are going to pursue the high end, your business plan should have realistic unit volume expectations. Unrealistic forecasts create pressure on sales organizations to sell to marginal dealers to “make numbers.”

Third, branding is important, but dealer education and training is crucial for success. Most small brands don’t have enough money to launch an effective consumer branding campaign. It is pointless to try. I recommend my clients spend at least as much on dealer education and support programs as they do for consumer branding. In fact, many consumers are so overwhelmed by consumer electronic brand choices these days that they seek out high-end dealers to avoid making a brand decision! They depend upon the dealer’s professional judgment to make the call and recommend the right solution. Brand investments (like ads in WSR, brochures, in-store displays, and a good website) should be made in a way that reinforces and support the dealer’s recommendations.

Dave